Your What is a golden cross in stocks images are ready. What is a golden cross in stocks are a topic that is being searched for and liked by netizens now. You can Get the What is a golden cross in stocks files here. Find and Download all royalty-free vectors.

If you’re looking for what is a golden cross in stocks images information connected with to the what is a golden cross in stocks keyword, you have come to the ideal site. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

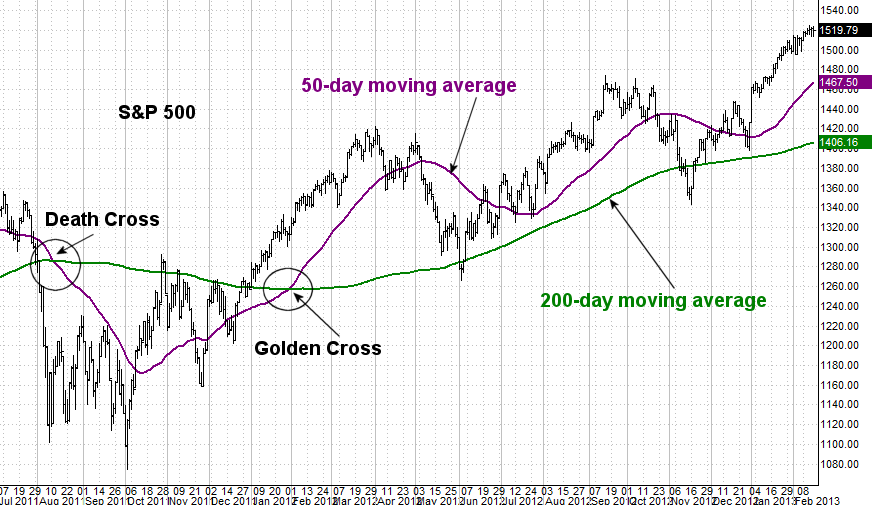

What Is A Golden Cross In Stocks. Is the Golden Cross still possible if the stock IPOd less than 200 days ago. In late 2012early 2013 there was another very brief death cross that happened but had you sold stocks at that point you would have missed out on a phenomenal rally that began almost immediately in early 2013 when the Fed began QE3. This list is generated daily ranked based on market cap and limited to. According to Joseph Granville a famous technician from the 1960s who set out 8 famous rules for trading the 200-day MA a golden cross can only occur when both the 50-day and 200-day moving averages are rising.

Goldencross Indicators And Signals Tradingview From tradingview.com

Goldencross Indicators And Signals Tradingview From tradingview.com

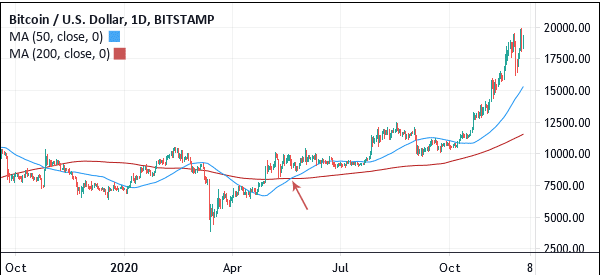

In late 2012early 2013 there was another very brief death cross that happened but had you sold stocks at that point you would have missed out on a phenomenal rally that began almost immediately in early 2013 when the Fed began QE3. A golden cross happens when a short-term moving average crosses over a long-term moving average MA toward the upside. To understand the concept of a golden cross and trading golden cross stocks you first need to come to grips with the idea of moving averages. Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. Golden Cross on a stock chart. In their most basic form a moving average takes the closing price of a stock from each of the previous days over a given period- lets say 50 days and then divided.

Golden Cross Chart Pattern.

For a recently IPOd stock which only has a 50 day moving average is it even possible to predict a. In their most basic form a moving average takes the closing price of a stock from each of the previous days over a given period- lets say 50 days and then divided. Even better the second golden cross pays off as the foreign exchange rate rises to top off at a high of 14889 over 100 pips above the support level. For a recently IPOd stock which only has a 50 day moving average is it even possible to predict a. Obviously the golden cross happens when the 50 day moving average crosses and exceeds the 200 day moving average. What is a golden cross.

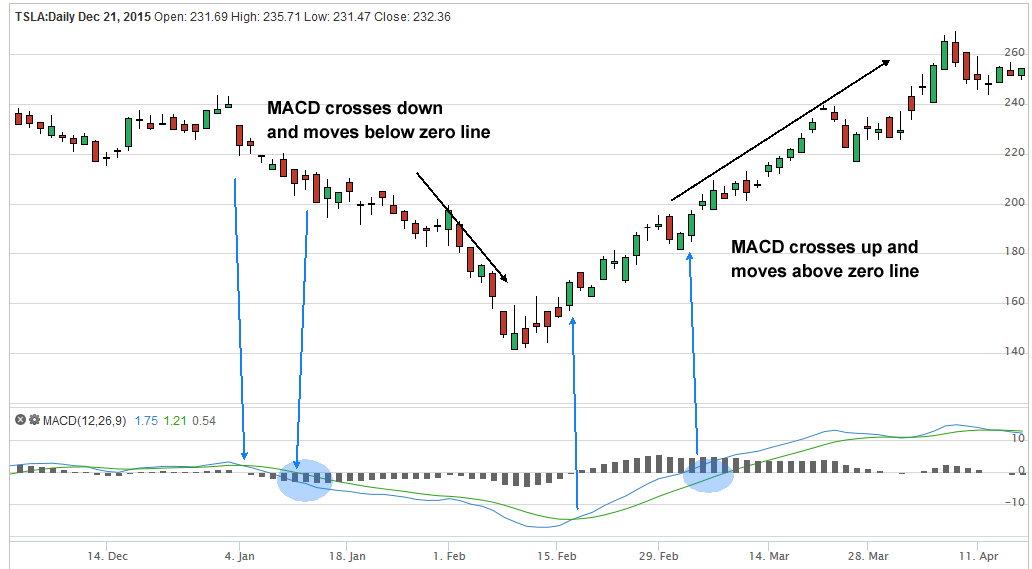

Therefore this shows that prices are gaining. Notice how the golden crosses in the slow stochastic oscillator just to the left of the chart were able to confirm long buy entries in the EURUSD as the purple line crosses the yellow line upward. The original golden cross trading strategy has its origins in the stock market. What is a golden cross. This is probably a very dumb question but I cant seem to find an answer anywhere else.

Source: investopedia.com

Source: investopedia.com

For a recently IPOd stock which only has a 50 day moving average is it even possible to predict a. This list is generated daily ranked based on market cap and limited to. According to Joseph Granville a famous technician from the 1960s who set out 8 famous rules for trading the 200-day MA a golden cross can only occur when both the 50-day and 200-day moving averages are rising. This is typically a telltale sign of bullish sentiment for a stock reinforced by high. In their most basic form a moving average takes the closing price of a stock from each of the previous days over a given period- lets say 50 days and then divided.

Source: bigtrends.com

Source: bigtrends.com

For a recently IPOd stock which only has a 50 day moving average is it even possible to predict a. The Golden Cross is a bullish chart pattern used in technical analysis that is to help predict future price movement. For a recently IPOd stock which only has a 50 day moving average is it even possible to predict a. Specifically it is when a short-term moving average which reflects recent prices rises above a long-term moving average which is also the longer-term trend. There are 0 symbols in this channel.

Source: tradingview.com

Source: tradingview.com

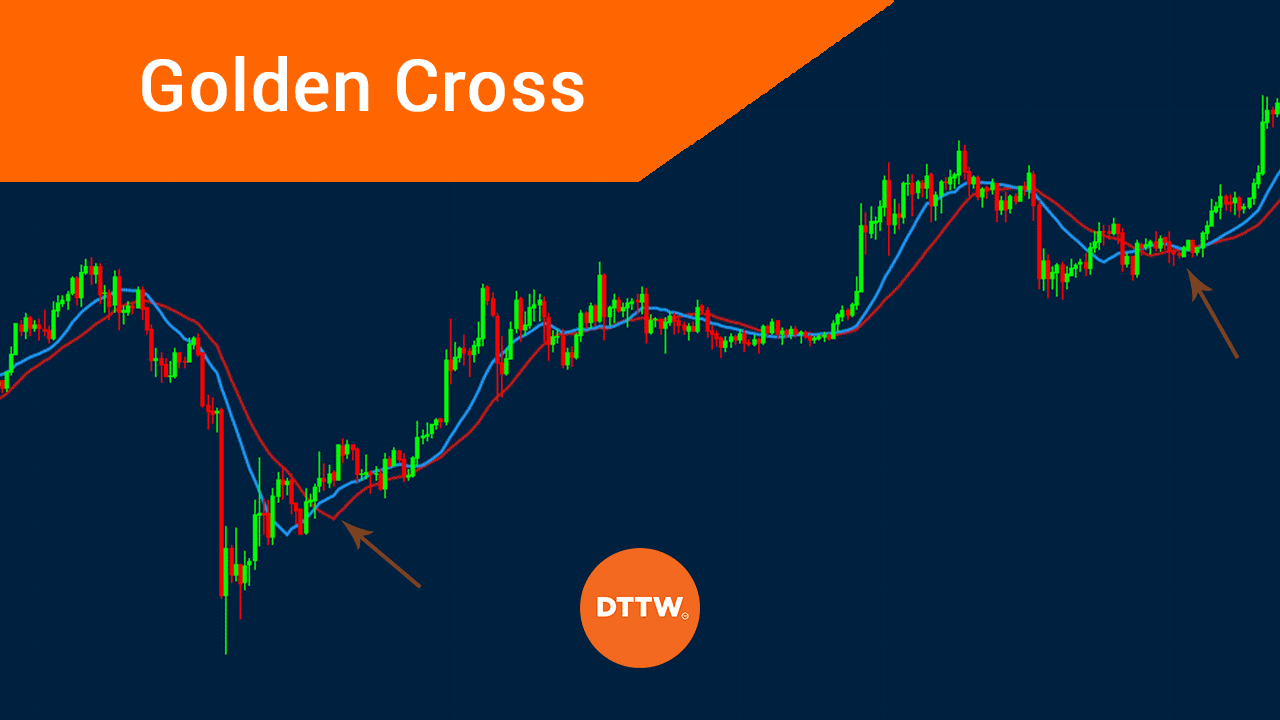

Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. What is a golden cross. Watch these videos to learn how Symbol Surfing. When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. A golden cross is the crossing of two moving averages a technical pattern indicative of the likelihood for prices to take a bullish turn.

Source: investopedia.com

Source: investopedia.com

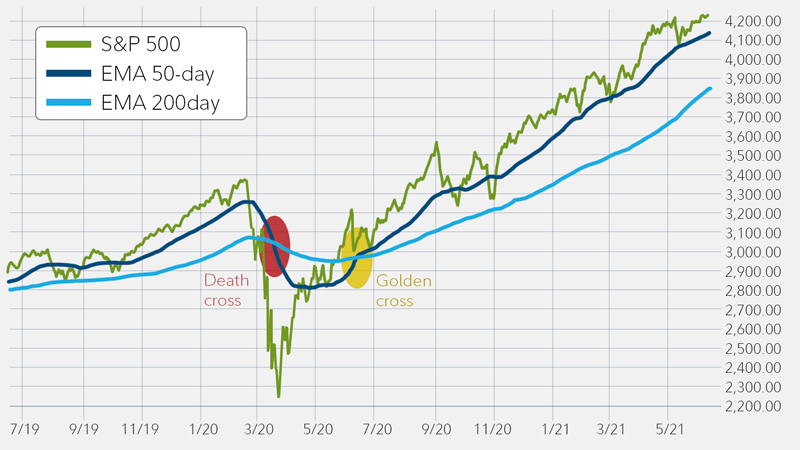

In contrast to the cross of death the golden cross is a strongly positive market indicator indicating the beginning of a long-term upswing. On a stock chart the golden cross occurs when the 50-day MA rises sharply and crosses over the 200-day MA. A Golden Cross is when a stocks 50 day moving average crosses above the 200 day moving average. This list is generated daily ranked based on market cap and limited to. Is the Golden Cross still possible if the stock IPOd less than 200 days ago.

Source: speedtrader.com

Source: speedtrader.com

The golden cross pattern is when a short-term moving average pattern crosses above a long-term moving average. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above the 200-day MVA. When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. In contrast to the cross of death the golden cross is a strongly positive market indicator indicating the beginning of a long-term upswing. This is typically a telltale sign of bullish sentiment for a stock reinforced by high.

Source: stockmonitor.com

Source: stockmonitor.com

Notice how the golden crosses in the slow stochastic oscillator just to the left of the chart were able to confirm long buy entries in the EURUSD as the purple line crosses the yellow line upward. This is typically a telltale sign of bullish sentiment for a stock reinforced by high. In the trading world a Golden Cross occurs when the 50 day moving average rises above its 200 day average. A golden cross forms when a short term moving average crosses over a longer-term moving average. Even better the second golden cross pays off as the foreign exchange rate rises to top off at a high of 14889 over 100 pips above the support level.

Source: tradingsim.com

Source: tradingsim.com

Typically traders use the 50-day and 200-day figures. A golden cross forms when a short term moving average crosses over a longer-term moving average. Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. Summary - A golden cross is a technical indicator that is always a predictor of a bullish trend for stocks and other securities. A golden cross is the crossing of two moving averages a technical pattern indicative of the likelihood for prices to take a bullish turn.

Source: tradingindepth.com

Source: tradingindepth.com

This is probably a very dumb question but I cant seem to find an answer anywhere else. When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. The Golden Cross To find a golden cross technical analysts plot two moving averages of a stock or other assets price – a short-term average and a long-term average. A golden cross is a technical pattern that occurs when a securitys short-term moving average crosses above its long-term moving average. A golden cross forms when a short term moving average crosses over a longer-term moving average.

Source: investopedia.com

Source: investopedia.com

There are 0 symbols in this channel. A golden cross is a technical pattern that occurs when a securitys short-term moving average crosses above its long-term moving average. The golden cross pattern is when a short-term moving average pattern crosses above a long-term moving average. This is probably a very dumb question but I cant seem to find an answer anywhere else. This is often considered a bullish indicator or a buy signal.

Source: speedtrader.com

Source: speedtrader.com

101 rows Golden Cross- SMA 50 Crossing above SMA 200 - Technical Screener. What is a golden cross. This is probably a very dumb question but I cant seem to find an answer anywhere else. A golden cross forms when a short term moving average crosses over a longer-term moving average. The golden cross happened on February 12 2012.

Source: speedtrader.com

Source: speedtrader.com

A golden cross happens when a short-term moving average crosses over a long-term moving average MA toward the upside. Even better the second golden cross pays off as the foreign exchange rate rises to top off at a high of 14889 over 100 pips above the support level. Please select a date below. The golden cross pattern is when a short-term moving average pattern crosses above a long-term moving average. Golden Cross Chart Pattern.

Source: fidelity.com

Source: fidelity.com

In many cases a simple 50-day and 200-day moving average are used. Golden Cross on a stock chart. Golden Cross Chart Pattern. This is because a longer time frame is usually predictive of a. Summary - A golden cross is a technical indicator that is always a predictor of a bullish trend for stocks and other securities.

Source: flowbank.com

Source: flowbank.com

What is a Golden Cross. This is probably a very dumb question but I cant seem to find an answer anywhere else. Summary - A golden cross is a technical indicator that is always a predictor of a bullish trend for stocks and other securities. The original golden cross trading strategy has its origins in the stock market. This is often considered a bullish indicator or a buy signal.

Source: tradingview.com

Source: tradingview.com

The golden cross pattern is when a short-term moving average pattern crosses above a long-term moving average. According to Joseph Granville a famous technician from the 1960s who set out 8 famous rules for trading the 200-day MA a golden cross can only occur when both the 50-day and 200-day moving averages are rising. To understand the concept of a golden cross and trading golden cross stocks you first need to come to grips with the idea of moving averages. This is probably a very dumb question but I cant seem to find an answer anywhere else. Typically traders use the 50-day and 200-day figures.

Source: daytradetheworld.com

Source: daytradetheworld.com

The Golden Cross To find a golden cross technical analysts plot two moving averages of a stock or other assets price – a short-term average and a long-term average. On a stock chart the golden cross occurs when the 50-day MA rises sharply and crosses over the 200-day MA. Therefore this shows that prices are gaining. There are 0 symbols in this channel. In contrast to the cross of death the golden cross is a strongly positive market indicator indicating the beginning of a long-term upswing.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Summary - A golden cross is a technical indicator that is always a predictor of a bullish trend for stocks and other securities. When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. A golden cross is a technical pattern that occurs when a securitys short-term moving average crosses above its long-term moving average. There are zero symbols here. This is seen as bullish.

Source: daytradetheworld.com

Source: daytradetheworld.com

A golden cross forms when a short term moving average crosses over a longer-term moving average. In contrast to the cross of death the golden cross is a strongly positive market indicator indicating the beginning of a long-term upswing. According to Joseph Granville a famous technician from the 1960s who set out 8 famous rules for trading the 200-day MA a golden cross can only occur when both the 50-day and 200-day moving averages are rising. This list is generated daily ranked based on market cap and limited to. This is often considered a bullish indicator or a buy signal.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is a golden cross in stocks by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.